Ecommerce pricing in the USA continues to evolve rapidly. In 2025, consumers and brands alike are paying closer attention than ever to price drops, deal patterns, and competitive pricing across major marketplaces. Amazon, Walmart, and Target are among the biggest platforms in the United States, and monitoring how prices change on these sites provides critical insights into consumer behavior, retail strategy, and marketplace competitiveness.

In this deep dive, we explore price drop and deal mapping for Amazon, Walmart, and Target in 2025, using structured data collected and analyzed by Food Data Scrape. This blog highlights key trends, methodologies, sample datasets, and actionable insights that online sellers, retail analysts, and consumer brands can use.

Why Price Drop Mapping Matters in 2025

Price drops do more than just attract bargain buyers. In an increasingly data-driven ecommerce ecosystem, tracking and understanding price shifts can:

- Reveal retailer promotional strategies

- Help brands maintain competitive pricing

- Show seasonal and category-specific deal trends

- Influence pricing algorithms and repricing decisions

Price drop data also feeds into broader price intelligence dashboards, competitive benchmarking, and consumer trend forecasting.

In 2025, with inflationary pressures easing in some categories and supply chain costs normalizing, price drop analysis has become a centerpiece of ecommerce analytics.

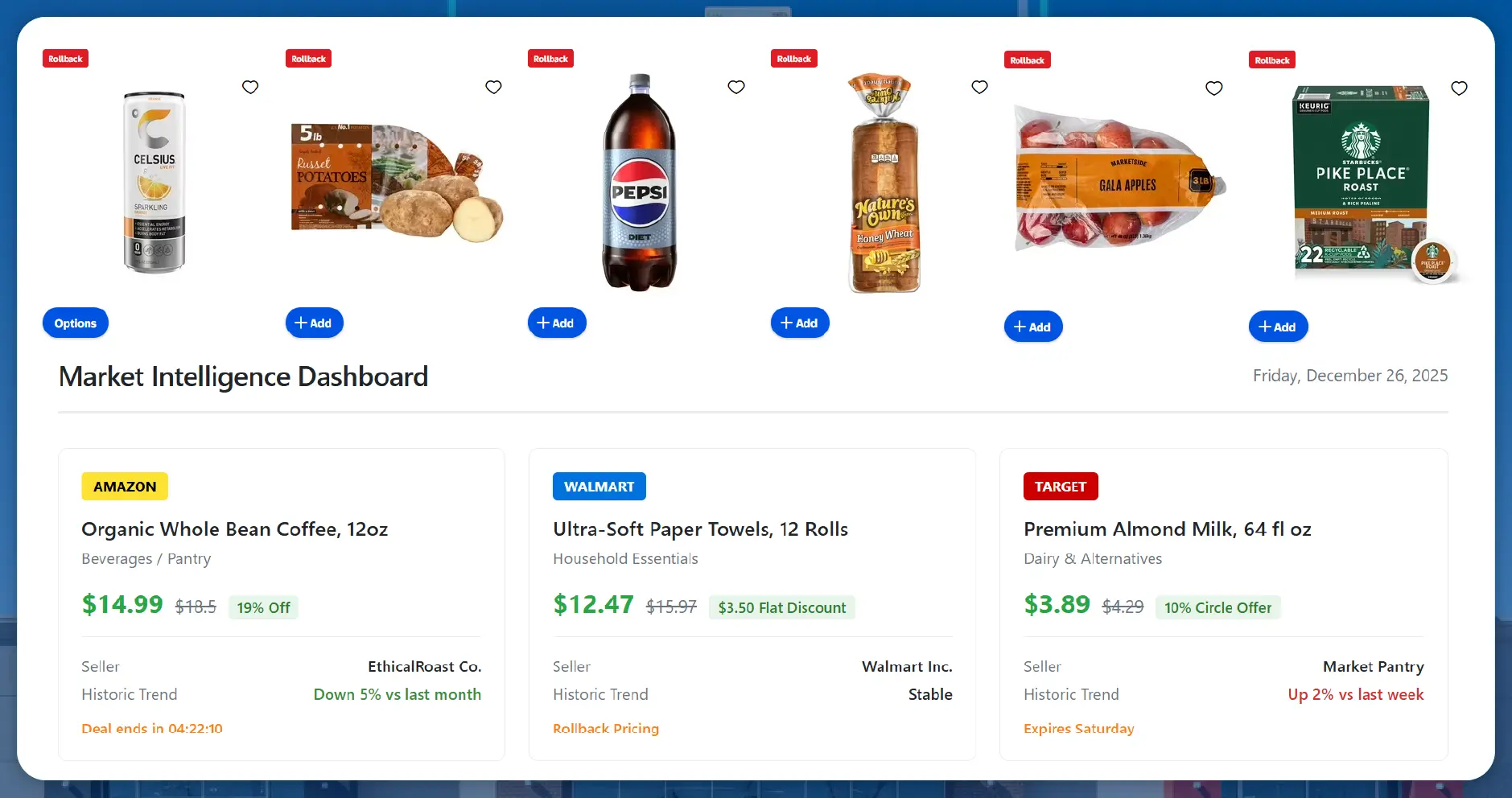

Data Collection: How Food Data Scrape Captures Price Drops

To analyze price drops comprehensively, Food Data Scrape uses advanced price tracking and data scraping APIs to monitor millions of SKUs across Amazon, Walmart, and Target. Prices are recorded at frequent intervals (hourly, daily) and normalized to enable comparison.

Data points typically collected include:

- Product title and category

- Seller information (for marketplace SKUs)

- List price vs current price

- Historic price trend

- Discount type (percentage or flat amount)

- Deal duration or expiration indicators

By continuously collecting this data, Food Data Scrape builds a rolling dataset that enables price drop mapping, trend analysis, and deal pattern detection.

Overview of 2025 Price Drop Trends

Across Amazon, Walmart, and Target, 2025 brought some clear pricing patterns:

- Electronics and accessories saw frequent flash deals coinciding with online events and product launches.

- Home and kitchen categories experienced prolonged seasonal discounts during mid-year months.

- Toys and games had sharp price drops in back-to-school and pre-holiday periods.

- Beauty and personal care prices fluctuated frequently due to competitive promotions and seller competition.

Below, we break down these insights platform by platform.

Amazon Price Drop Dynamics

Amazon’s marketplace structure leads to unique pricing behavior. With multiple sellers often listing the same SKU, prices can vary dramatically by seller and time of day.

Sample Amazon Price Drop Data

| Product | Category | List Price | Current Price | Discount | Price Drop Date |

|---|---|---|---|---|---|

| Apple AirPods Pro (2nd Gen) | Electronics | $249.00 | $199.00 | 20% | 2025-09-12 |

| Instant Pot Duo 7-in-1 | Home/Kitchen | $99.00 | $74.00 | 25% | 2025-06-22 |

| LEGO Star Wars Set | Toys | $179.99 | $149.99 | 17% | 2025-11-05 |

This snapshot shows typical price drops during peak promotional windows, seasonal sales, and flash deal cycles.

Walmart Pricing Patterns

Walmart adopts a different strategy. As a major brick-and-mortar retailer with a strong online presence, Walmart pricing reflects both inventory clearance strategies and price matching against competitors.

Sample Walmart Price Data

| Product | Category | List Price | Current Price | Discount | Price Drop Date |

|---|---|---|---|---|---|

| Samsung 55" LED TV | Electronics | $499.00 | $429.00 | 14% | 2025-10-18 |

| Vitamix Blender | Home/Kitchen | $399.00 | $359.00 | 10% | 2025-07-15 |

| Barbie Dreamhouse | Toys | $199.99 | $159.99 | 20% | 2025-12-02 |

Walmart’s price drops tend to align with inventory cycles and cross-channel pricing initiatives.

Target Deal Mapping

Target combines promotional campaigns with loyalty pricing through programs like Target Circle, which can influence price perception.

Sample Target Price Drop Data

| Product | Category | List Price | Current Price | Discount | Price Drop Date |

|---|---|---|---|---|---|

| Dyson Vacuum Cleaner | Home | $499.99 | $449.99 | 10% | 2025-08-30 |

| Ninja Air Fryer | Home/Kitchen | $129.99 | $99.99 | 23% | 2025-05-10 |

| PlayStation 5 Console | Electronics | $499.99 | $449.99 | 10% | 2025-11-20 |

Target pricing behavior often reflects broader promotional calendars and loyalty-driven deals.

Comparative Price Drop Insights

To better understand cross-platform pricing, Food Data Scrape aggregated price drop data across all three retailers.

Combined Price Drop Summary

| Category | Amazon Avg Discount | Walmart Avg Discount | Target Avg Discount |

|---|---|---|---|

| Electronics | 18% | 12% | 11% |

| Home/Kitchen | 22% | 15% | 18% |

| Toys & Games | 20% | 18% | 19% |

| Beauty/Care | 15% | 13% | 14% |

This table reveals that electronics and home categories see the most significant price drops on Amazon, while Walmart and Target also participate in competitive discounting.

Seasonal Deal Patterns in 2025

Price drops often follow seasonal and event-based triggers:

Mid-Year (June–July)

- Amazon flash deals surge during Prime Day events.

- Walmart matches prices on key electronics and appliances.

- Target pushes mid-year clearance offers.

Back-to-School (August–September)

- Discounts on laptops, backpacks, and school supplies across all platforms.

- Amazon and Walmart emphasize bundle deals.

- Target features loyalty offers and Circle discounts.

Holiday & Q4 (November–December)

- Sharp price drops during Black Friday week.

- Target and Walmart join Amazon’s holiday pricing play.

- Toys and games see sustained demand-driven discounts.

Sample seasonal trend data:

| Season | Amazon Avg Drop | Walmart Avg Drop | Target Avg Drop |

|---|---|---|---|

| Mid-Year Sales | 20% | 17% | 18% |

| Back-to-School | 15% | 13% | 14% |

| Black Friday & Holidays | 25% | 22% | 21% |

Category-Level Price Drop Analysis

Electronics

Electronics pricing is highly competitive due to rapid model refreshes and frequent promotions. Amazon leads in discount depth, often tied to events like Prime Day and new product announcements.

Home & Kitchen

Home and kitchen products see consistent pricing pressure due to inventory cycles and cross-retailer price matching.

Toys & Games

Toys typically see sharp drops during holiday quarters and promotional windows.

How Brands Can Use Price Drop Data

Retailers and brands can leverage price drop insights to:

- Set dynamic pricing rules

- Forecast promotional impact

- Align inventory planning with deal calendars

- Optimize product launch pricing

- Monitor competitor pricing shifts

Integrating Price Drop Data Into Business Workflows

Food Data Scrape delivers price drop datasets via:

- CSV and Excel for offline analytics

- REST API (JSON) for automated workflows

- BI integrations with dashboards and visualization tools

A sample API price drop response might look like:

{

"product_id": "AMZ123456",

"product_name": "Apple AirPods Pro (2nd Gen)",

"platform": "Amazon",

"list_price": 249.00,

"current_price": 199.00,

"discount_percent": 20,

"price_drop_date": "2025-09-12"

}

Sample Price Drop Dataset (Combined Snapshot)

| SKU | Platform | Category | List Price | Current Price | Discount % | Drop Date |

|---|---|---|---|---|---|---|

| AMZ001 | Amazon | Electronics | $249.00 | $199.00 | 20% | 2025-09-12 |

| WMT001 | Walmart | Home/Kitchen | $399.00 | $359.00 | 10% | 2025-07-15 |

| TGT001 | Target | Toys & Games | $199.99 | $159.99 | 20% | 2025-12-02 |

| AMZ002 | Amazon | Beauty/Care | $49.99 | $42.99 | 14% | 2025-08-08 |

| WMT002 | Walmart | Electronics | $499.00 | $429.00 | 14% | 2025-10-18 |

Common Price Drop Triggers

Flash Events

Frequent on Amazon, especially tied to platform-specific campaign days.

Inventory Clearance

Seen on Walmart when newer models replace older stock.

Loyalty & Circle Discounts

Target’s loyalty programs often trigger price drops independent of site-wide campaigns.

Challenges in Price Monitoring

While price data is valuable, there are challenges:

- SKU matching across platforms requires normalization

- Marketplace sellers (especially on Amazon) can cause pricing volatility

- Seasonal promotions differ significantly by product category

- Price APIs need frequent refresh cycles for accuracy

Food Data Scrape solves these challenges with automated scraping infrastructure and normalization logic.

Future Outlook: Price Drops in 2026

Looking ahead, price drop mapping will continue to play a major role in ecommerce strategy. Retailers are increasingly using AI-driven pricing models, and consumer expectations for competitive pricing will remain high.

Brands that invest early in price intelligence will be better positioned for:

- Forecasting deal windows

- Automating repricing rules

- Anticipating competitor moves

- Aligning stock and promotions

Conclusion

In 2025, price drop and deal mapping for Amazon, Walmart, and Target reveals clear patterns that smart brands and retailers can leverage. With platforms competing for market share, understanding when and how prices shift is essential.

Using structured datasets from Food Data Scrape, businesses can monitor price drops, analyze deal patterns, and adapt pricing strategies that align with real market behavior.

This deep dive demonstrates how price intelligence adds measurable value to revenue optimization, competitive benchmarking, and consumer engagement strategies.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.