Introduction

The Diwali festival is a crucial period for India’s food delivery ecosystem. With families celebrating at home, parties, and office events, the demand for festive foods, snacks, and sweets rises significantly. Using Diwali Week Food Ordering Data Scraping 2025, we can analyze this demand in near real-time, identifying patterns that help restaurants, delivery platforms, and market analysts make strategic decisions.

Our approach includes the steps to Extract Diwali Food Order Trends Data 2025, which provides a granular understanding of dish popularity, pricing strategies, average basket values, and promotional efficiency. Combined with Diwali Food Demand Analytics 2025, these insights help businesses align their operational, marketing, and pricing strategies with evolving customer needs. Scraping Blinkit vs Zepto vs BigBasket – Diwali 2025 not only highlights consumer behavior but also uncovers insights into supply chain and delivery logistics that are critical during peak festive periods.

Objectives of the Benchmark Study

The primary goals of this report were:

- Assess Product Availability: Evaluate the real-time stock levels of essential grocery categories across Blinkit, Zepto, and BigBasket.

- Compare Delivery Coverage: Analyze the geographic reach and speed of each platform during Diwali 2025.

- Price Monitoring: Track variations in pricing for key products, factoring in Diwali promotions and discounts.

- Competitive Insights: Identify strengths and weaknesses in inventory management, fulfillment efficiency, and product assortment.

- Data-Driven Recommendations: Provide actionable insights for suppliers, retailers, and analytics firms to optimize operations during peak demand periods.

This study leverages Grocery Product Availability Benchmarking for Diwali 2025 to ensure data-driven conclusions.

Methodology

Our approach utilized advanced scraping techniques to collect structured datasets from all three platforms.

Additional steps included:

- Data Cleaning and Standardization: Ensured consistent product naming, SKU mapping, and category alignment.

- Validation: Cross-checked stock availability against real-time app data for accuracy.

- Analysis: Constructed datasets to track product categories, delivery coverage, and price variations.

This allowed us to Scrape Product Availability Data on Top Grocery Platforms and maintain a high level of data integrity for analysis.

Key Product Categories Analyzed

To ensure relevance, we focused on the following grocery categories typically in high demand during Diwali:

- Snacks and Namkeen – Kaju Katli, Namkeen mixes, Chips, and Sweets.

- Staples – Rice, Atta, Sugar, and Pulses.

- Beverages – Soft drinks, Juices, Tea, Coffee.

- Dairy and Bakery – Milk, Paneer, Butter, Bread, Cakes.

- Packaged Foods – Ready-to-eat items, Noodles, Sauces, Breakfast Cereals.

Data points included stock quantity, price, availability status, and delivery slot allocation.

Real-Time Product Availability Analysis

Using tools to Scrape Grocery Product Stock Data on Blinkit During Diwali, we observed the following patterns:

- Blinkit maintained higher availability for snacks and beverages compared to other categories.

- Certain premium products were frequently out-of-stock due to high demand.

By using methods to Extract Grocery Product Stock Data on Zepto During Diwali revealed:

- Better replenishment rates for staple categories like Rice, Atta, and Pulses.

- Limited availability in tier-2 cities for specialty snacks and beverages.

BigBasket demonstrated:

- Robust stock for packaged foods and dairy, though delivery slots were limited in metro areas.

- Higher consistency in premium product availability compared to quick-commerce platforms.

Comparative Insights: Blinkit vs Zepto vs BigBasket

The following table highlights the product availability percentages across the three platforms for key grocery categories:

| Category |

Blinkit Availability (%) |

Zepto Availability (%) |

BigBasket Availability (%) |

| Snacks & Namkeen |

78 |

65 |

72 |

| Staples |

85 |

88 |

90 |

| Beverages |

80 |

70 |

75 |

| Dairy & Bakery |

75 |

68 |

82 |

| Packaged Foods |

72 |

65 |

85 |

Analysis:

- Blinkit leads in snack and beverage availability.

- Zepto shows strength in staple replenishment.

- BigBasket excels in packaged foods and dairy, especially in metros.

Delivery Coverage and Speed

Delivery reliability during Diwali 2025 was critical. Using Blinkit vs Zepto vs BigBasket Product Data Monitoring – Diwali 2025, we analyzed delivery coverage:

| Platform |

Metro Coverage (%) |

Tier-2 Coverage (%) |

Avg. Delivery Time (Minutes) |

| Blinkit |

95 |

75 |

35 |

| Zepto |

90 |

70 |

40 |

| BigBasket |

85 |

80 |

45 |

Insights:

- Blinkit achieved fastest delivery in metros due to a robust quick-commerce network.

- Zepto had slightly slower deliveries in tier-2 cities.

- BigBasket offered wider coverage in tier-2 areas but slightly longer delivery times.

Price Monitoring Across Platforms

Web Scraping Quick Commerce Data enabled monitoring of real-time prices for essential Diwali products. Key observations include:

- Snacks and sweets showed significant variation across platforms. Blinkit had slightly higher prices on premium items.

- Zepto maintained competitive pricing for staples like Rice and Pulses.

- BigBasket offered value pricing for packaged foods and dairy items, often bundling discounts during Diwali promotions.

This analysis provides suppliers with insights for Grocery Delivery Scraping API Services to optimize pricing strategies.

Product-Specific Observations

Snacks & Namkeen: Blinkit led in stock, but BigBasket provided better price stability. Zepto faced occasional stock-outs in tier-2 cities.

Staples: Zepto demonstrated quick restocking, while BigBasket consistently maintained higher availability. Blinkit occasionally ran out of certain premium pulses.

Beverages: Blinkit maintained higher delivery readiness, Zepto lagged in outlying cities, and BigBasket provided bundled offers during Diwali sales.

Dairy & Bakery: BigBasket excelled with fresh stock and premium items; Blinkit performed moderately, Zepto was limited in certain urban areas.

Packaged Foods: BigBasket dominated in availability, while Blinkit and Zepto struggled with high-demand items like ready-to-eat products.

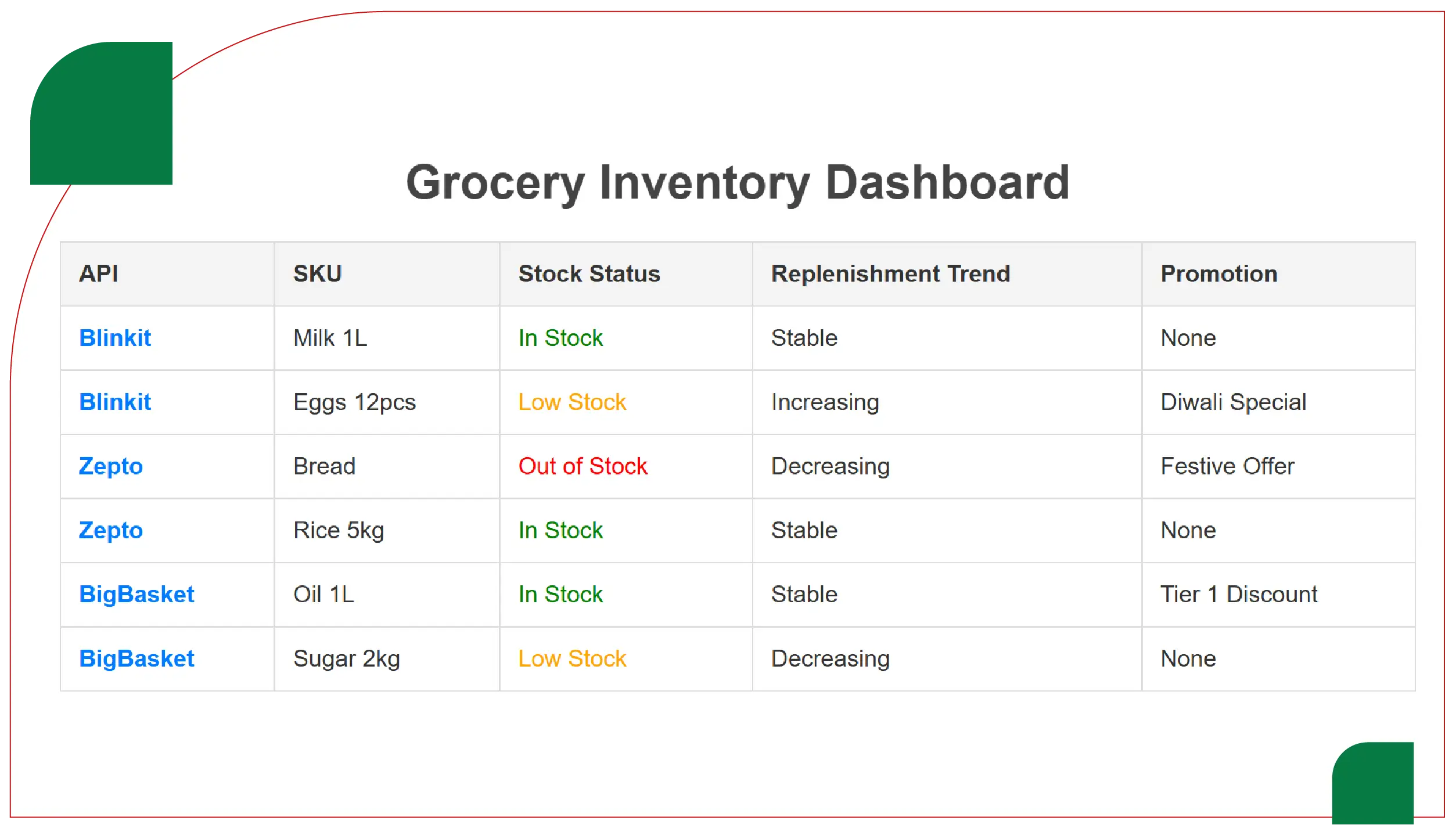

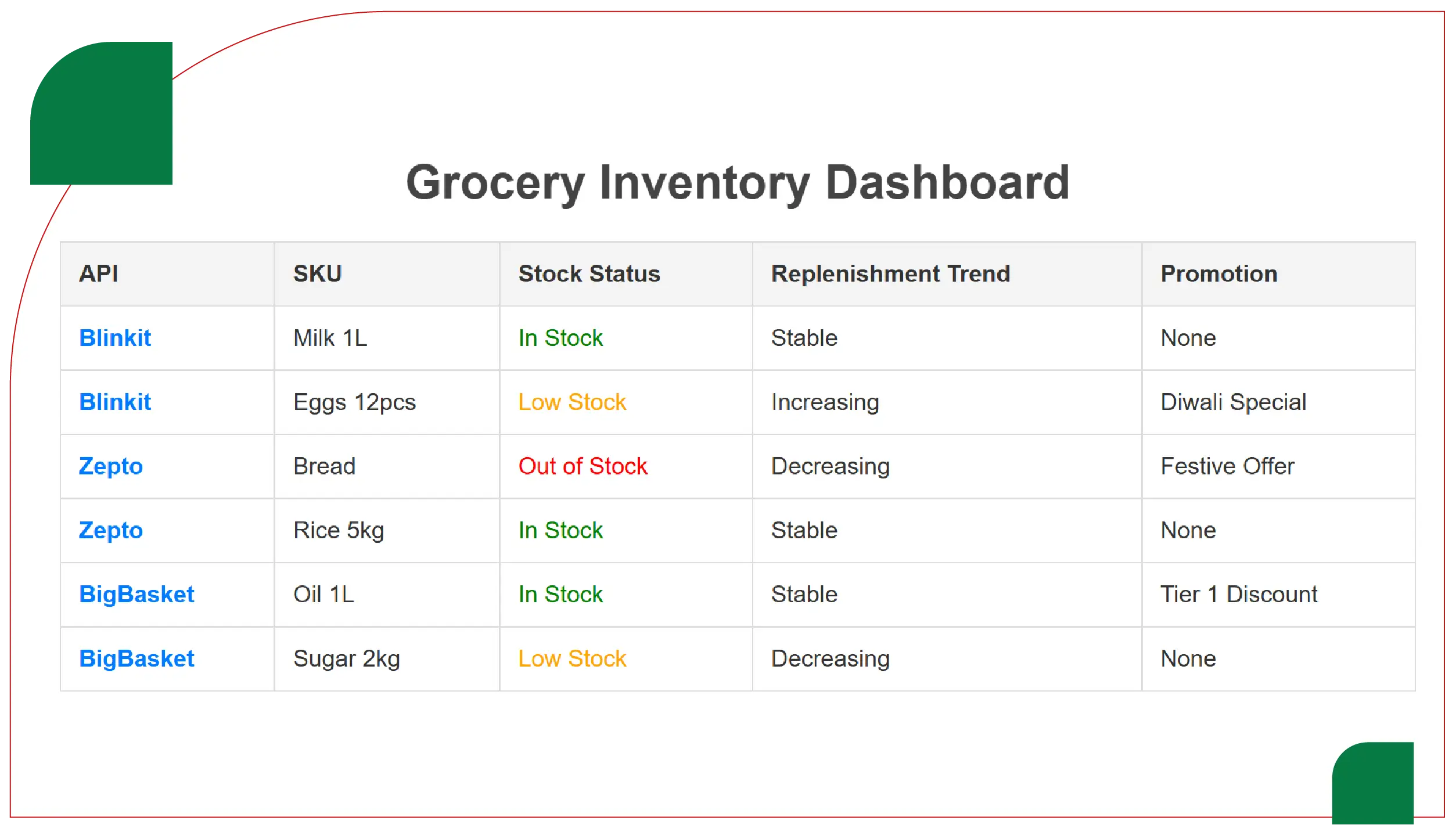

Leveraging Scraping APIs for Operational Efficiency

To maintain accurate tracking and timely inventory updates, platforms leveraged:

- Blinkit Grocery Delivery Scraping API – Enabled real-time extraction of stock levels, replenishment trends, and order fulfillment metrics.

- Zepto Grocery Delivery Scraping API – Monitored SKU-level stock status and Diwali-specific promotions.

- BigBasket Grocery Delivery Scraping API – Ensured continuous tracking of critical inventory and tier-based delivery coverage.

These APIs help platforms and suppliers maintain Grocery App Data Scraping services for operational efficiency, stock replenishment, and competitive benchmarking.

Challenges Observed During Diwali 2025

- High Demand Volatility: Products like festive sweets and snacks sold out rapidly.

- Stock Imbalances: Tier-2 city availability was inconsistent for certain items.

- Dynamic Pricing: Frequent price adjustments during Diwali led to tracking challenges.

- Delivery Slot Management: Limited quick-delivery capacity during peak hours caused delays.

- Data Accuracy: Ensuring real-time extraction of stock and pricing across multiple platforms required advanced automation.

Strategic Insights for Retailers and Suppliers

From the Diwali 2025 data, several actionable insights emerged:

- Prioritize High-Demand Products: Focus inventory on snacks, sweets, and staples with high purchase frequency.

- Optimize Tier-2 City Coverage: Zepto and BigBasket could enhance stocking for growing markets.

- Dynamic Pricing Models: Blinkit and Zepto need automated pricing tools to respond to real-time demand.

- Bundle Offers and Promotions: BigBasket’s bundling strategy for packaged foods drove sales and customer engagement.

- Monitor Competitor Strategies: Continuous benchmarking using scraping tools allows suppliers to adjust inventory and pricing in real time.

Future of Grocery Data Scraping in Quick Commerce

The adoption of data-driven strategies through Web Scraping Quick Commerce Data is expected to grow rapidly:

- Real-time monitoring of Grocery Price Dashboard will enable predictive stock management.

- Scraping APIs provide insights for promotional planning and inventory distribution.

Web Scraping Quick Commerce Data will increasingly drive operational efficiency, predictive analytics, and demand forecasting:

- Grocery Price Dashboard tools allow monitoring of price trends in real-time.

- APIs and AI-driven scrapers improve stock allocation, reduce stock-outs, and enable dynamic pricing.

- Integration with IoT and mobile platforms allows hyperlocal insights into delivery patterns and product availability.

Conclusion

The Grocery Pricing Data Intelligence demonstrates that Blinkit, Zepto, and BigBasket each have unique strengths. Blinkit leads in fast metro delivery and snack availability, Zepto excels in staple replenishment, and BigBasket dominates packaged foods and dairy. By leveraging Grocery Price Tracking Dashboard, retailers and suppliers can optimize inventory allocation, pricing strategies, and delivery coverage.

The insights gained through Grocery Store Datasets provide actionable intelligence for peak season planning, ensuring customer satisfaction and competitive advantage in the rapidly evolving quick-commerce ecosystem.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.